Companies in the Zacks Shoes and Retail Apparel industry have been benefiting from continued demand for activewear and footwear, given the adoption of a healthy lifestyle. The industry players focused on product innovation, store expansion, digital investments and omni-channel growth are poised to gain in the current market. This has compelled the activewear segment to resort to innovations to make their assortments more comfortable and fashionable. However, elevated costs related to supply-chain headwinds, as well as to support brand campaigns and digital investments have been deterrents.

The industry participants have been consistently investing in product innovation based on customer feedback and requirements. Investments in products and e-commerce portals bode well for players like Deckers Outdoor DECK, Skechers U.S.A., Inc. SKX, Steven Madden SHOO, Caleres CAL and Rocky Brands RCKY.

About the Industry

The Zacks Shoes and Retail Apparel industry comprises companies that design, source and market clothing, footwear and accessories for men, women and children under various brand names. The product offerings of the companies mostly OluKai Shoes include athletic and casual footwear, fashion apparel and activewear, sports equipment, bags, balls, and other sports and fashion accessories. The companies showcase their products through their branded outlets and websites. However, some companies also distribute products via other retail stores such as national chains, online retailers, sporting goods stores, department stores, mass merchandisers, independent retailers and catalogs.

A Look at What’s Shaping Shoes and Retail Apparel Industry’s Future

Fitness Trends Aid Industry: Rising health consciousness and the willingness to live an active lifestyle and look fit have led consumers to incorporate sports and fitness routines into their daily lives. The demand for activewear/athleisure products has increased significantly over time, which is expected to accelerate in 2022. Athletic goods and apparel companies now offer everything from sweatshirts, leggings, pants, jackets and tops to yoga wear and running clothes for both men and women. People are clubbing athleisure styles like tops with blazers to give them a formal look at office meetings. The participants remain focused on product innovations, store expansion and enhancing e-commerce capabilities to gain market share. The companies continue to innovate styles, materials and colors and incorporate functional designs to grab a large share of the fast-growing market. The increased participation of women in sports and outdoor activities in recent years has been a boon for the industry.

E-Commerce Investments: E-commerce has been playing a crucial role in the athleisure market’s growth. The companies in the segment are looking to build a customer base through websites, social media and other digital channels. As consumers continue to show interest in shopping from home, growth of athletic-inspired apparel and digital sales are likely to stay. Companies focused on expanding their athletic-based apparel lines and building on e-commerce capabilities are expected to witness growth in 2022. Efforts to accelerate deliveries through investments in supply chain and order fulfillment avenues are likely to provide an edge in the market. Simultaneously, companies are investing in renovations and improved checkouts as well as mobile point-of-sale capabilities to make stores attractive. The efforts to enhance the guest experience through multiple channels are likely to contribute significantly to improving traffic and transactions both in stores and online.

Cost Headwinds: Companies are witnessing elevated costs due to factors like commodity cost inflation, increase in freight costs and reinvestments and other impacts. A number of companies project increased freight and logistics costs to hurt margins in the near term. Elevated marketing expenses, higher operating overhead and demand-creating expenses, and increased investments toward enhancing store and digital operations have been pushing up SG&A costs. Also, the companies are witnessing higher costs to support brand campaigns and digital investments. Hoka One One The return of sporting activities and events has resulted in higher costs compared with the last year’s COVID-related closure. Additionally, a tough and competitive labor market remains a concern. These factors pose a threat to industry players’ margins.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Shoes and Retail Apparel Industry is a 12-stock group within the broader Zacks Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #96, which places it in the top 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence in this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and the valuation picture.

Industry Vs. the Sector

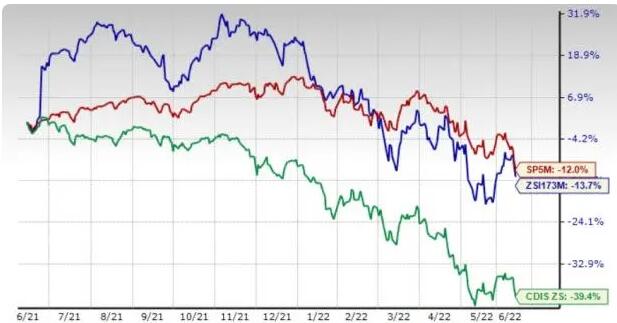

The Zacks Shoes and Retail Apparel industry has outperformed its sector but underperformed the S&P 500 in the past year.

While stocks in the industry have collectively declined 13.7%, the Zacks S&P 500 composite has dropped 12%. Meanwhile, the Zacks Consumer Discretionary sector has declined 39.4%.

One-Year Price Performance

Shoes and Retail Apparel Industry’s Valuation

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing Consumer Discretionary stocks, the industry is currently trading at 22.07X compared with the S&P 500’s 16.65X and the sector’s 17.52X.

Over the last five years, the industry has traded as high as 36.79X and as low as 19.59X, with the median being at 25.81X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Shoes & Retail Apparel Stocks to Watch

Caleres: Caleres is a leading footwear retailer and wholesaler in the United States, China, Canada, China, and Guam. It operates through Famous Footwear and Brand Portfolio segments. The stock of this Saint Louis, MO-based company has been benefiting from positive consumer demand trends and accelerated recovery in the footwear marketplace, which have been aiding its sales. The momentum in the Famous Footwear brand is expected to contribute meaningfully to sales growth. Strong performances of CAL’s emerging brands, including Vionic, Sam Edelman, Allen Edmonds and Blowfish Malibu, are expected to be drivers.

Management anticipates strong performance at the Famous Footwear brand and gains in Brand Portfolio, leveraging of diversified brand model and Chippewa Boots the continued execution of ongoing strategic priorities to aid CAL’s performance. Caleres’s focus on the consumer’s evolving preferences and efforts to drive growth across its omni-channel ecosystem bode well. The consensus estimate for CAL’s fiscal 2022 EPS has moved up 11.3% in the past 30 days. The company has a trailing four-quarter earnings surprise of 62.9%, on average. Shares of this Zacks Rank #1 (Strong Buy) company rose 0.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here. .

Price and Consensus: CAL

Rocky Brands: Rocky Brands is a leading footwear and accessories company that designs, manufactures and markets premium quality footwear and apparel under a portfolio of well-recognized brand names. The company’s notable brands portfolio includes Rocky, Georgia Boot, Durango, Lehigh, The Original Muck Boot Company, XTRATUF, Servus, NEOS and Ranger. RCKY is benefiting from the flexibility and ability to innovate quickly, given its small size of business.

Rocky Brands has been witnessing robust demand for its portfolio of leading brands, which has been aiding performance. The company is making strong progress in regaining the full efficiency of its Ohio distribution center, which along with the new distribution center in Reno, NV, is likely to have improved shipping capacity. The Zacks Consensus Estimate for its 2022 earnings has been unchanged in the past 30 days. It has a trailing four-quarter negative earnings surprise of 2.3%, on average. This Zacks Rank #1 stock has declined 32.6% in the past year.

Price and Consensus: RCKY

Steven Madden: Steven Madden designs, sources, markets and sells fashion-forward name brand and private label footwear for women, men, and children and private label fashion handbags and accessories globally. SHOO has been gaining from a robust e-commerce momentum, product assortments and accelerated business recovery. The company’s focus on creating trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda, expanding international markets and efficiently controlling expenses bodes well. This has been boosting consumer demand, thereby contributing to the overall performance for a while now.

Strength in SHOO’s digital and brick-and-mortar channels bodes well. Management is on track to expand the international business. The company’s e-commerce wing continues to gain from prudent investments in digital marketing as well as efforts to optimize the features and functionality of its website. Steven Madden has also been significantly accelerating its digital commerce initiatives with respect to distribution. SHOO has a trailing four-quarter earnings surprise of 44%, on average. The consensus estimate for the company’s 2022 EPS has moved down by a penny in the past seven days. Shares of the Zacks Rank #2 (Buy) footwear company have declined 18.2% in the past year.

Price and Consensus: SHOO

Skechers: Skechers is a leading manufacturer and seller of footwear for men, women and children in the United States and overseas. SKX has been gaining from the continued demand for comfort products and momentum in the direct-to-consumer business. Skechers remains focused on developing comfort footwear, expanding apparel offerings, advancing e-commerce capabilities and tapping opportunities to drive overall sales. Growth across the domestic and international channels, driven by wholesale and direct-to-consumer sales, bodes well. The company remains committed to directing resources to enhance its digital capabilities, which include augmenting website features, mobile applications and loyalty programs. Investments made to integrate store and digital ecosystems for developing a seamless omnichannel experience are likely to drive greater sales.

Skechers’ investments in long-term growth strategies, including brands and infrastructural capabilities, have been yielding results. Management is optimistic regarding the strength of its brands and the relevance of its products in the forthcoming periods. Shares of the Manhattan Beach, CA-based company have declined 19.5% in the past year. The company has a trailing four-quarter earnings surprise of 23.6%, on average. The consensus estimate for SKX’s 2022 EPS has been unchanged in the past 30 days. It currently carries a Zacks Rank #3 (Hold).

Price and Consensus: SKX

Deckers: This Goleta, CA-based company is a leading designer, producer, and brand manager of innovative, niche footwear and accessories developed for outdoor sports, and other lifestyle-related activities. The company sells products primarily under five proprietary brands — UGG, HOKA, Teva, Sanuk, and Koolaburra. Strength in HOKA ONE ONE and UGG brands as well as growth in direct-to-consumer and wholesale channels has been aiding DECK’s performance. Deckers is targeting profitable and underpenetrated markets, and remains focused on product innovations, store expansion and enhancing e-commerce capabilities. The company’s focus on expanding its brand assortments, bringing a more innovative line of products, targeting consumers digitally and optimizing omni-channel distribution bode well.

In keeping with the changing trends, Deckers has been constantly developing its e-commerce portal to capture incremental sales. DECK has made substantial investments to strengthen its online presence and improve shopping experience for its customers. The company’s focus on opening smaller concept omni-channel outlets and expanding programs such as Retail Inventory Online; Infinite UGG; Buy Online, Return In Store; and Click and Collect to enhance customers’ shopping experience is likely to boost the top line in the quarters ahead. DECK has a trailing four-quarter earnings surprise of 1,115%, on average. Shares of the Zacks Rank #3 company have declined 19.3% in the past year. The consensus estimate for its fiscal 2023 EPS has moved up 3.4% in the past 30 days.

Price and Consensus: DECK