Jeremy Hunt is expected to announce a 2p cut to National Insurance when he delivers his Budget on Wednesday.

The plan – which matches a cut announced in the Autumn Statement – was first reported in The Times.

Mr Hunt has promised his Budget will help families with “permanent” tax cuts and stimulate a flagging economy.

Labour said any reductions would be cancelled out by the government’s previous decision to freeze the thresholds people start paying tax.

The move means a pay rise is more likely to drag someone into a higher band so they pay more tax.

- Tax, childcare, vapes: What could be in the Budget?

- ‘I earn £1,600 a month and two-thirds goes on bills’

- Did the last Budget deliver growth and cheap beer?

- Do councils spend too much on diversity schemes?

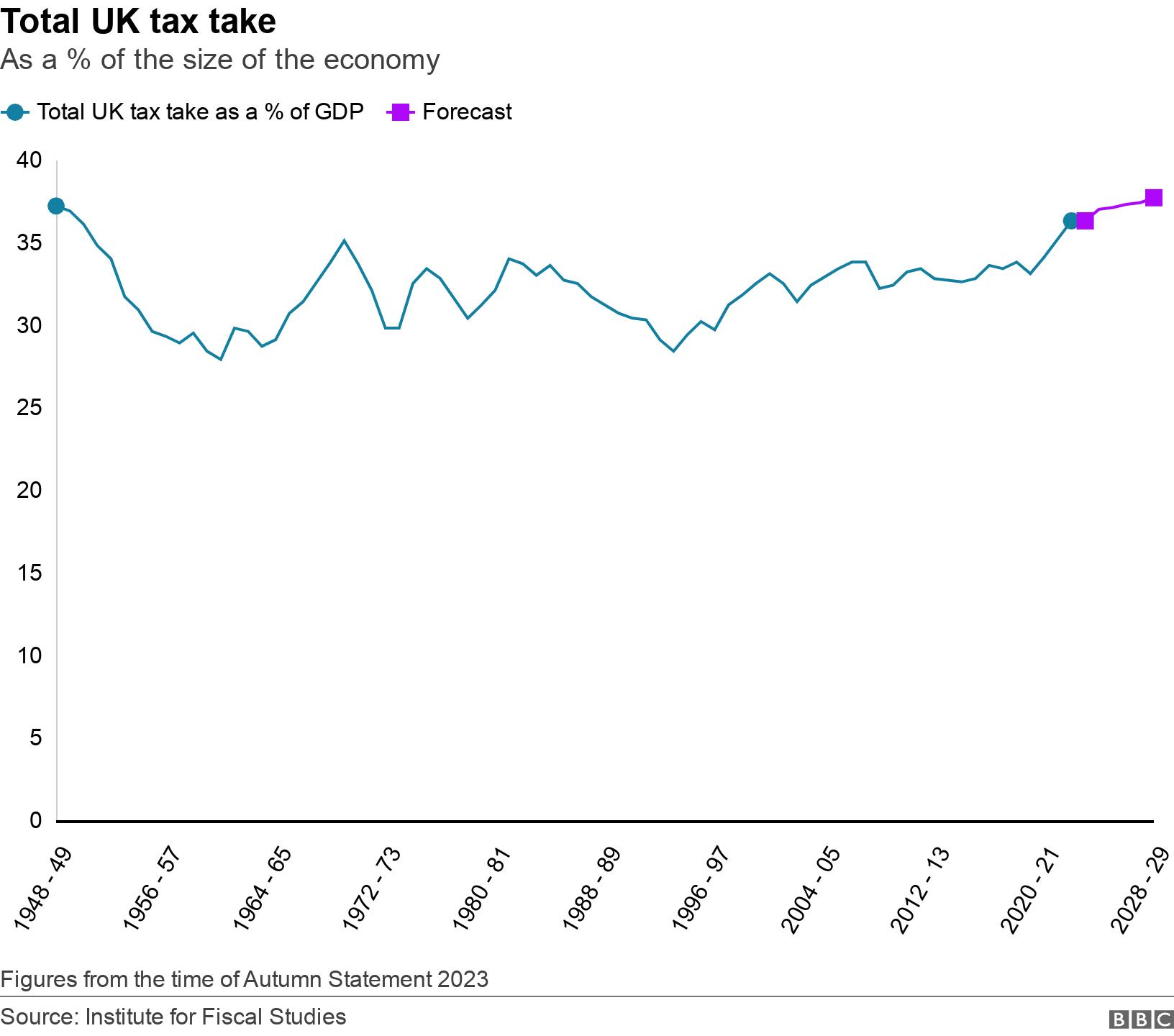

Mr Hunt has been under pressure, particularly from Tory MPs, to cut taxes currently at an historic high.

Cutting National Insurance is cheaper than cutting income tax. However, some Conservative MPs fear it is less well understood by many voters and so is less beneficial politically.

They have also argued that the initial cut to National Insurance has not improved the Conservatives’ political fortunes – a key consideration with the general election expected this year.

National Insurance contributions are paid by employees and the self-employed on their earnings, as well as employers.

The amount paid depends on an individual’s salary.

The focus of Wednesday’s cut is expected to be on employees rather than employers, as it was for the Autumn Statement, when the main rate was reduced from 12% to 10%.

A further 2p cut would be worth around £450 a year for someone on a full-time salary of £35,000.

There have also been reports that the Budget may include a headline-grabbing cut to income tax, despite the risk of fuelling inflation.

The Resolution Foundation suggest cutting the main rate of income tax by just 1p would cost £7bn this year.

Ahead of his Budget speech, Mr Hunt said that the government “can now help families with permanent cuts in taxation” only because of the progress made on reducing inflation.

He added: “We do this not just to give help where it is needed in challenging times. But because Conservatives know lower tax means higher growth.

“And higher growth means more opportunity and more prosperity.”

However, it comes against a backdrop of sluggish economic growth, with the country falling into recession at the end of last year.

In recent weeks the chancellor has also been emphasising that his scope for cutting taxes is not what he had hoped it would be, following a rise in the cost of borrowing.

‘Economic vandalism’

Labour believe the government has more room for manoeuvre than ministers have been suggesting and may cut income tax as well.

But Labour argue the Budget cannot “undo the economic vandalism of the Conservatives over the past decade”.

In a statement, shadow chancellor Rachel Reeves said: “The Conservatives promised to fix the nation’s roof, but instead they have smashed the windows, kicked the door in and are now burning the house down.”

Labour leader Sir Keir Starmer, when he responds to the Budget, will argue tax cuts now still leave people worse off because of the freezing of tax thresholds, which means many people are paying higher rates of tax than they used to.

Alongside the expected cut to National Insurance, Mr Hunt is set to freeze fuel duty for another year. The levy has not increased since 2011.

The BBC has also been told Mr Hunt will use his Budget to urge councils to reduce their spending on diversity schemes and consultants.

It comes as councils across the country have said they are struggling to balance the books.

This week councils in Birmingham and Nottingham have announced big cuts to services.

The Local Government Association has dismissed attacks on diversity schemes as a “distraction” arguing that councils spent “pence” on such projects.

Meanwhile, the chancellor is also considering other measures to raise revenue, including a new tax on vapes and scrapping non-dom tax status.

People with non-domiciled status are UK residents whose home for tax purposes is abroad. Under the current system, they do not have to pay UK tax on money they make overseas.

Labour has pledged to abolish non-dom status and spend the money generated on schools and the NHS.

If the party backs any tax cuts the chancellor announces, which they are expected to do, this would leave questions over how some of their spending pledges would be funded.